Below are seven key insights from a recent study of our own in New York and Los Angeles, where we explored running footwear with 18 young and forward-thinking runners.

Running is evolving—fast.

From the rise of micro-brands to the redefinition of performance, runners today are shaping the sport in new and unexpected ways. Sources of influence are shifting, and in-person experiences are playing a bigger role than ever. As brand loyalty fragments and runners seek deeper, more authentic connections, brands need to rethink their approach—niching down, showing up where it matters, and prioritizing real-world engagement.

Insight #1: Micro Brands & Influencers

“Bandit and Satisfy are sleek, clean, put together, with an urban flair. I see myself in their image, and the people I follow aren’t just taking a pill to get fit; they’re doing the work.”

Only 1 in 15 runners we’ve met feel tied to a single brand, reflecting an openness to innovation if it serves a purpose, which paired with the increasing accessibility to more technical footwear manufacturing for new start ups, has given rise to so many new running brands–case in point, have you heard of Mount To Coast, Norda and Nnormal?

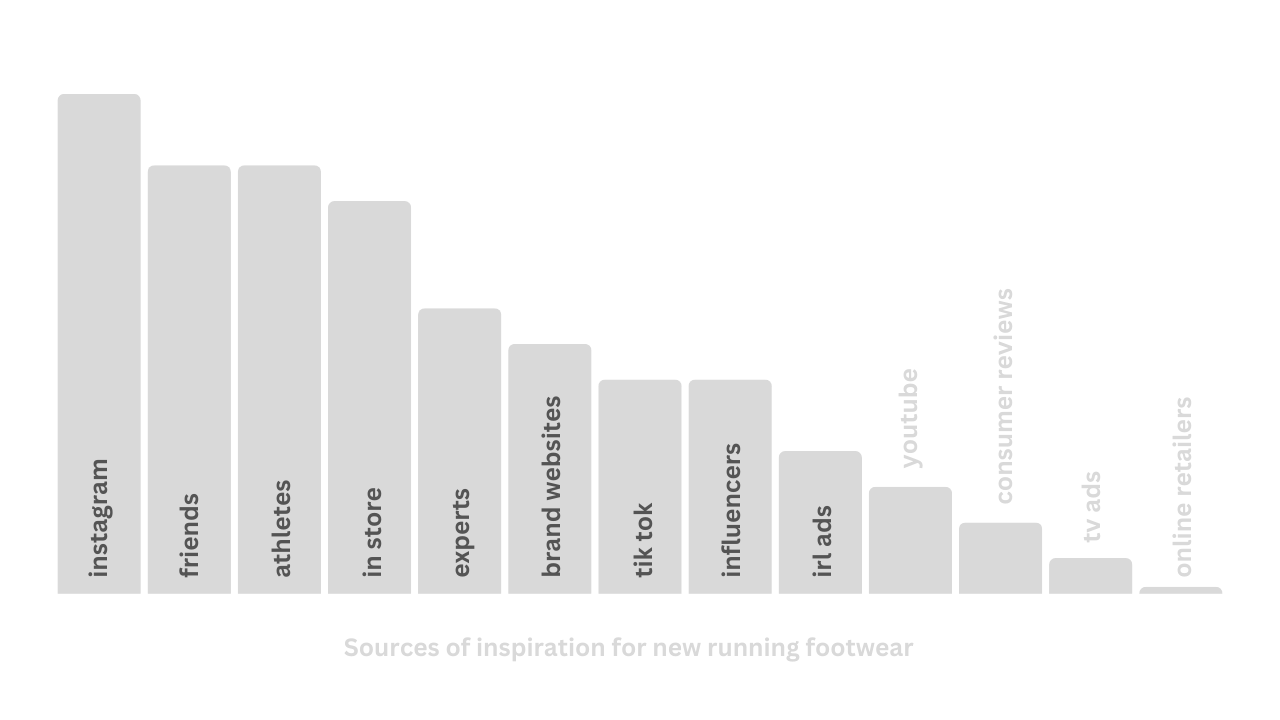

Equally, we continue to hear from runners that Instagram is the #01 source of shoe influence, alongside friends and other athletes, and in an age where running has never had as much cultural currency as it does today, we’re seeing the “running influencer” at the forefront of many of these new brands, blending aspiration with a pinch of relatability, and launching more new entrants into the space than ever before.

With more appetite for newness, more accessible shoe manufacturing, and influence driven less by huge marketing budgets and more by grassroots community and micro influencers, we find ourselves in a start-up era in running, begging the question how can big brands remain relevant? We think the answer may lie in niching down, doing more in less places.

Insight #2: IRL Brand Experiences

“Since I got fitted in Specialty, it changed the whole way I run. There's something to be said for having these people who know running and do it on a daily basis, and the chance to try the product and explore what's best for my foot.”

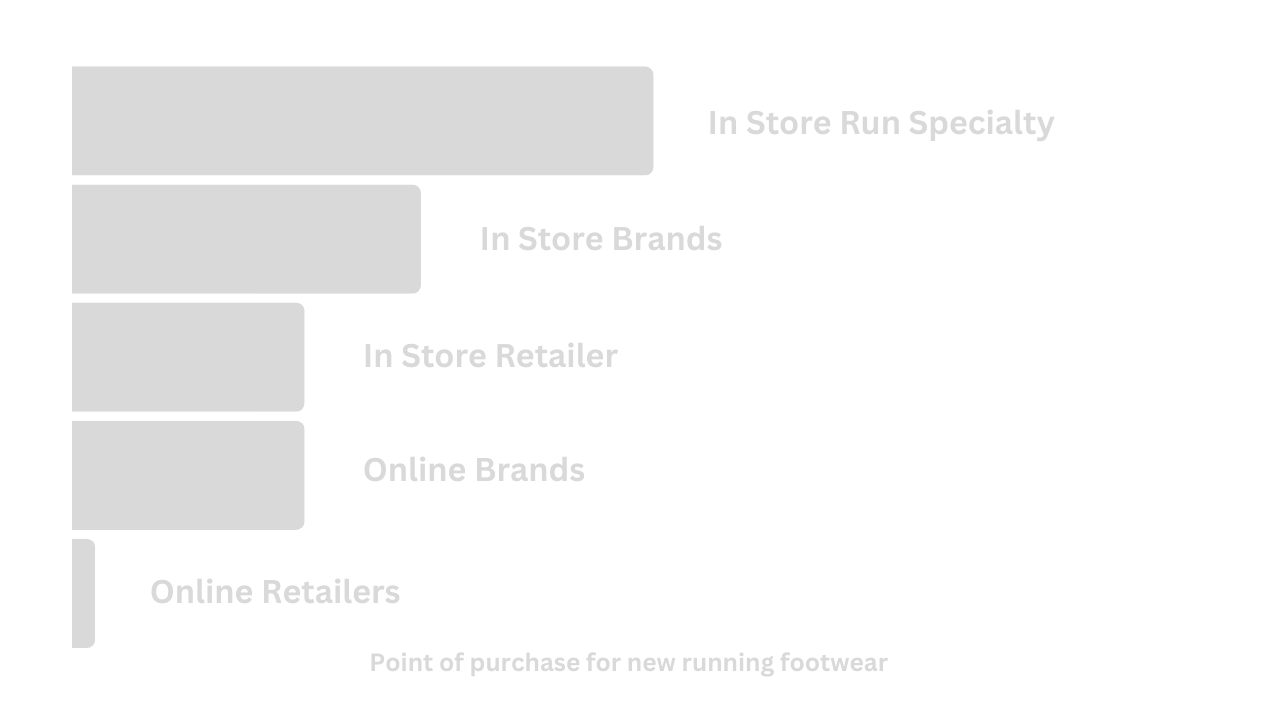

For today’s runners, we continue to find peer recommendations in run clubs are a primary catalyst to discovering new running trends, further fueled by word-of-mouth, on-foot visibility and brand sponsored events in their run club. Equally, in-store running specialty continues to provide a key second touchpoint, especially to try these new trends. Runners value expert insights, personalized fitting, and the ability to try out a range of products firsthand in a pressure-free environment.

While consumers have yet to catch on to the fact that many specialty stores do place brand sponsored product ahead of others, the intersection of running and style has seen lots of exciting new boutique stores such as LSD, Renegade and Downbeat, inject more life into a once mom and pop driven shopping experience.

While online purchasing is still preferred for familiar models and discounted options, we found 2/3rd’s of runners we met are still purchasing in store vs online, suggesting in person retail and specialty stores remain irreplaceable in guiding runners toward new running shoes. How is your brand showing up in this specialty retail and on a community level?

Insight #3: From Clean To Clinical

"I don’t trust the healthcare system. I’ll listen to a doctor if their science makes sense, but they can be wrong—like your parents sometimes. The experts I trust, like Huberman, are runners themselves. There has to be a performance-to-talk ratio for it to feel reputable."

As health becomes a cultural cornerstone with rising trends like “sober curiosity” and “functional medicine”, running consumers are turning to trusted sources and expert voices beyond traditional healthcare. With over 70% of U.S. adults dissatisfied with the healthcare system and only 37% of 18–34-year-olds feeling empowered by medical advice, consumers are turning to trusted clinical influencers like Andrew Huberman, Peter Attia and Stacy Simms, who advocate for "Medicine 3.0," emphasizing preventative care and long-term well-being over short-term fixes.

Brands like Seed, Oura and Whoop are responding by prioritizing education with their influencers, ensuring data transparency sharing with doctors, and launching performance and wellness podcasts with these trusted experts.

Meanwhile, APMA stamps on Hoka and Brooks models do little to build trust, as many runners remain skeptical of generalized claims. As one respondent shared, "I take expert advice with 70% belief, then test for myself for the last 30%." Try-on and testing experiences remain critical in building trust. As 63% of Americans believe preventative wellness could save $3.5T in healthcare costs by 2040, how can brands shift from fee for products and services to value-based reimbursement, incentivizing outcomes over transactions that build trust?

Insight #4: Authenticity, Connection & Craft

"Bandit, On, and Hoka are hands-on, creating full communities and advocating for everyone—from professionals to newbies.”

Authenticity, community, and style are the 3 pillars we see driving the way running brands connect with consumers today. Nike’s recent return to its core values builds trust, while Bandit is praised for "knowing their lane," and on the other hand “it would be weird to see Arc'teryx with a road running shoe,” reinforcing that authenticity and knowing who you are is magnetic these days. On’s try on experiences and partnerships with emerging clubs like Run the Blocks highlight the ability to foster loyalty through in-person experiences.

We’ve found that runners are willing to spend on premium footwear, averaging $170 per pair in our experience, with style-forward buyers reaching upwards of $195. Equally, 2/3rd’s consider themselves knowledgeable about running shoes, meaning they can see through the bullshit so these new brands need to deliver right out the gate. Premium however is not always defined by price tags, but by quality craft, superior feel, and durability, with brands like Satisfy, UVU, 247 Represent, Schism, and Norda shining by blending performance with fashion.

Insight #5: Blending Wellness & High Style

"Wellness is about taking care of yourself; performance is about pushing your limits. But, there’s not enough middle ground between them."

Running brands almost always enter the market performance first, with brands like Bandit, Asics, and Brooks embodying a more function-driven positioning. On the other hand, wellness brands like Alo, Lululemon, Set Active, and Sporty & Rich, have entered the market from a feel and lifestyle-led space, but have struggled to bridge the gap into authentic performance. As one respondent noted about Alo’s new running shoe, "It looks cool, but it’s hard to trust a brand that’s been so focused on apparel."

Meanwhile we see another spectrum emerge on the style side, with brands like UVU, 247 Represent and Norda entering the market with a more masculine streetwear informed style, while a more feminine athleisure look is led by brands like Saysky and Bandit.

Designers will often say creating for everything leaves you with nothing, however we continue to see an unmet need in the middle of these two intersections where brands just cant seem to take leadership, especially from the fashion forward (masc or fem led) and feel-led space which seems primed to springboard of the rising wellness trend. Brands like On, Aritzia, Vuori, and Nike appear to be making headway here, offering versatile pieces that support active lifestyles and balance style with utility.

Insight #6: Comfort, Style & Quality

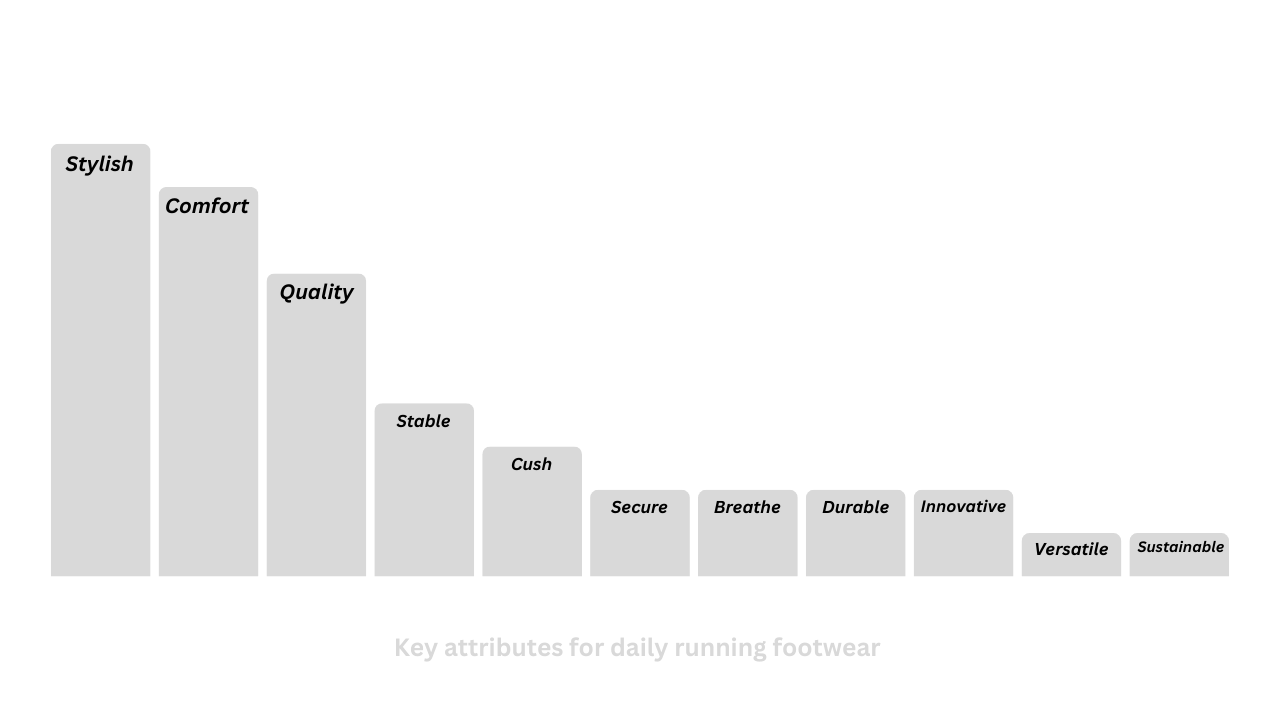

"A go-to daily trainer is light, molds, is comfortable and bouncy. It’s about how it feels over performance and tech."

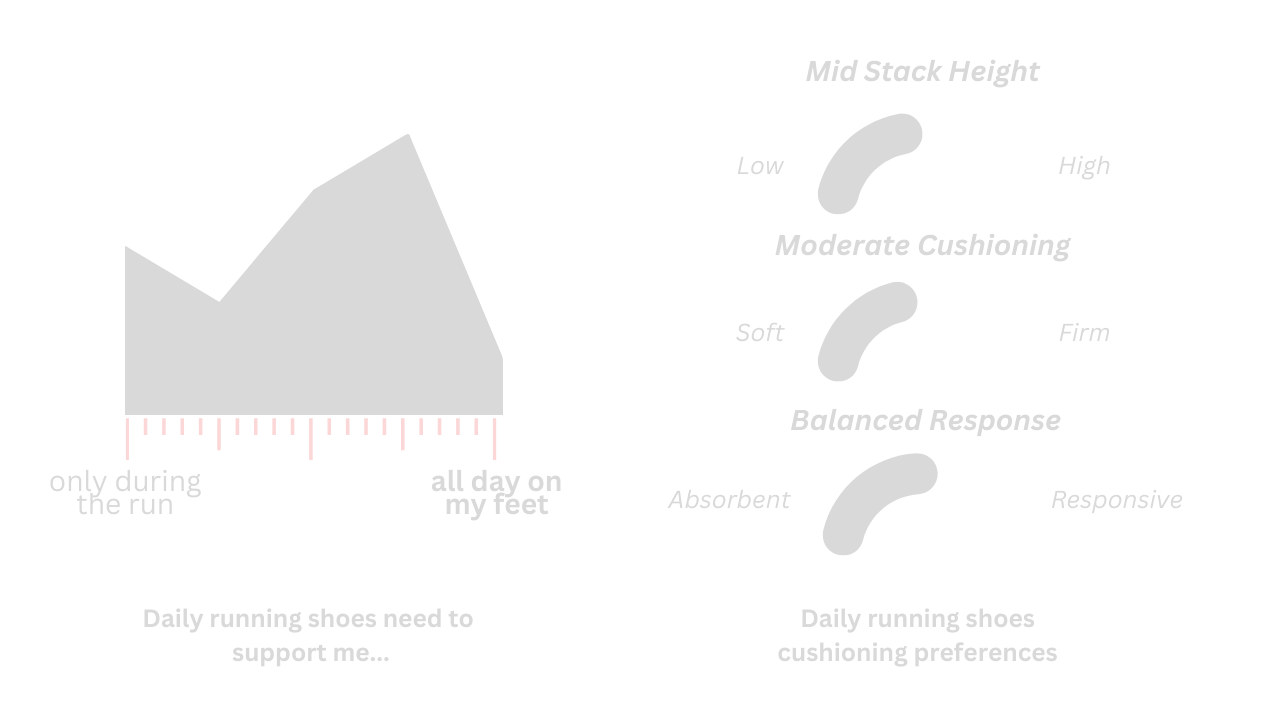

When it comes to daily running shoes, comfort continues to be a top priority alongside style and quality, with many valuing it over traditional performance features. The increasing intersection between running and lifestyle, as these runners seek to wear these shoes all day on their feet, is accelerating the demand for that sweet spot between ground feel and concrete comfort.

We’ve found technology plays a nuanced role these days, as many runners seek more practical innovation that extends that underfoot feel and build quality longer term throughout frequent wear over flashy features, underscoring the need for daily trainers to endure the demands of an active lifestyle and support long term body health vs just the run these days.

Insight #7: Redefining Comfort & Performance

"Comfort means no irritation, and it feels like I’m floating."

Ok we know… comfort is so vague… So we always ask what it means. From our experience comfort in daily trainers tends to be defined by most runners as eliminating irritation and allowing long periods of wear without discomfort or distraction.

Cushioning preferences tend to lean towards a balanced feel—moderate cushioning, providing bounce without excessive padding or sinkage, and middle range stack heights, the sweet spot between feeling “away from the ground, but feeling it” and “bounce, without my foot sinking.” The more advanced the runner they are, we tend to hear an ask for a little more energy return.

Performance from daily running footwear continues to be viewed as enhancing speed and efficiency, but often only for short-term gains, as few from our experience connect it with injury prevention or long-term body health—an opportunity perhaps for brands to reframe what running shoe performance could mean today, intersecting with the wellness boom.

In case you missed it, here’s our last insight report on 9 trends shaping the sport of running.

For more thoughts on any of these trends, insights or ideas, you can reach out to us at hello@comncollective.com